The Dow Jones Industrial Average (DJIA) is slipping on Tuesday as the index continues its negative momentum through December. A large part of that concerns the Federal Reserve meeting this month and the warning of interest rate cuts in 2025 that followed.

Don’t Miss Our New Year’s Offers:

Additionally, a recent tech stock selloff sent the index tumbling lower yesterday. That negative movement continues today, albeit to a much smaller degree, with a 0.15% drop as of this writing.

Despite these issues, the DJIA has performed well throughout 2024 and is set to close the year up almost 13%. That’s a positive for traders, even if concerns about 2025 are weighing on the market.

Stocks Weighing on the DJIA Index Today

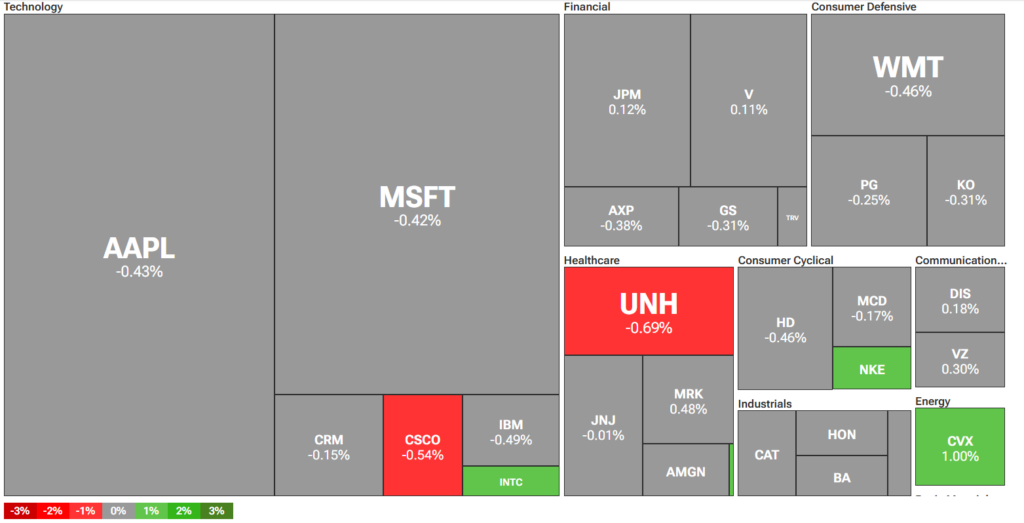

Looking at the TipRanks heatmap tool, we can evaluate stocks affecting the Dow Jones Industrial Average today. The majority of stocks aren’t seeing much movement on Tuesday, leaving the heatmap mostly grey. However, there are a couple of red spots that explain the slight slip the Dow Jones is seeing today. Cisco Systems (CSCO) and UnitedHealth (UNH) are keeping the index down as both have fallen more than half a percentage point.

How to Invest in the Dow Jones Index

The Dow Jones can’t be invested in directly as it’s only an index. Even so, investors have options for gaining exposure to it. That includes buying shares of companies listed on the index. Those falling today might be good options for their lowered entry points while rising stocks could be worth considering if traders expect them to increase in 2025.

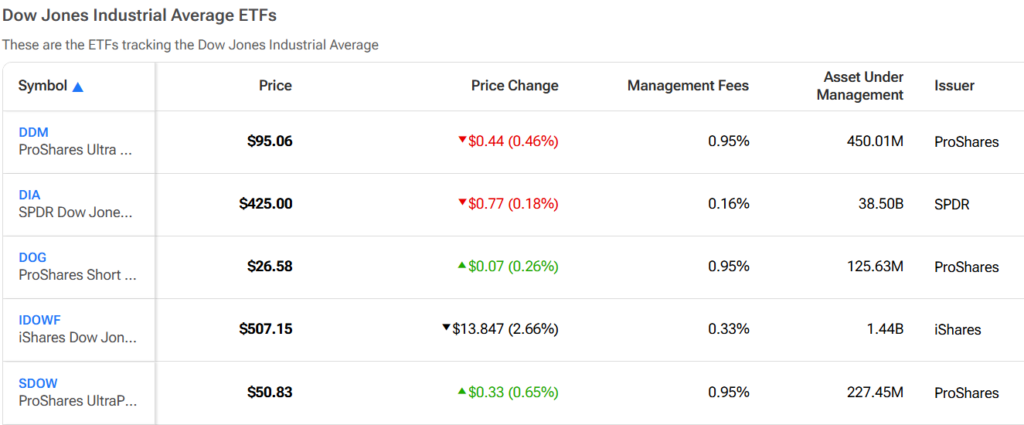

Another good option for traders is buying shares of exchange-traded funds (ETFs) that track the DJIA. This option allows them to bet on or against the index. One popular ETF worth considering is the SPDR Dow Jones Industrial Average ETF Trust (DIA), but there are plenty of options worth comparing below.

See more Dow Jones ETFs

Disclaimer