The Dow Jones Industrial Average (DJIA) is slipping Wednesday alongside the results from the Federal Reserve’s Federal Open Market Committee (FOMC) meeting. This meeting saw the central bank cut interest rates to between 4.25% and 4.5%, representing a 25 basis point drop. That brings with it a 0.42% fall for DJIA today.

Pick the best stocks and maximize your portfolio:

The stocks hitting the Dow Jones index today are spread across several sectors, such as technology, healthcare, industrials, energy, and communication.

What’s Next for the Dow Jones Index?

While today’s interest rate cut is good news, investors are already wondering what the future holds for the Dow Jones. The Fed has been considering additional interest rate cuts in 2025, but various factors could alter that plan, such as increasing inflation and a strong workforce.

Another major factor that can’t be ignored is incoming President Donald Trump. Trump’s term could bring with it major changes to the U.S.’s economic policies. That’s almost guaranteed the President-elect promising to introduce tariffs on foreign goods when he takes office. This could cause the central bank to adjust its plans to cut interest rates next year.

How to Invest in the Dow Jones Industrial Average

Investors can’t take a direct stake in the Dow Jones due to it being an index. However, there are a couple of options for gaining exposure to it. That includes buying shares of stocks listed in the index. Those mentioned above are solid options.

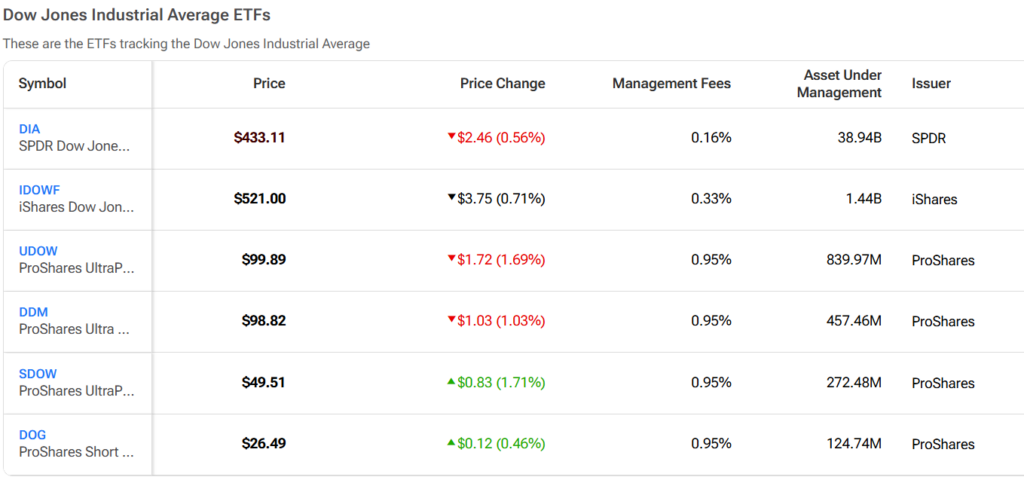

Another option for investing in the Dow Jones is exchange-traded funds (ETFs) that track the index. You can check out a few of those below with TipRanks’ comparison tool.

See more Dow Jones ETF data

Disclaimer