The Dow Jones Industrial Average (DJIA) is undergoing gigantic growth on Friday following the release of the November Personal Consumption Expenditures (PCE) report. That report includes inflation increasing by 2.3% year-over-year. While rising inflation doesn’t sound good, November’s is below experts’ 2.4% estimate.

Pick the best stocks and maximize your portfolio:

Lower-than-expected inflation has the stock market soaring today, bringing with it a huge 1.9% increase for the DJIA index as of this writing. That comes as investors regain hope that the Federal Reserve will continue interest rate cuts in 2025.

Interest rates have been a hot topic this week following the December Fed meeting, which brought a 25 basis point interest rate cut. However, it also warned that additional interest rate cuts could slow next year due to rising inflation. With the PCE report’s inflation coming in lower than estimates, this could change the central bank’s plan.

Stocks Sending the Dow Jones Index Soaring Today

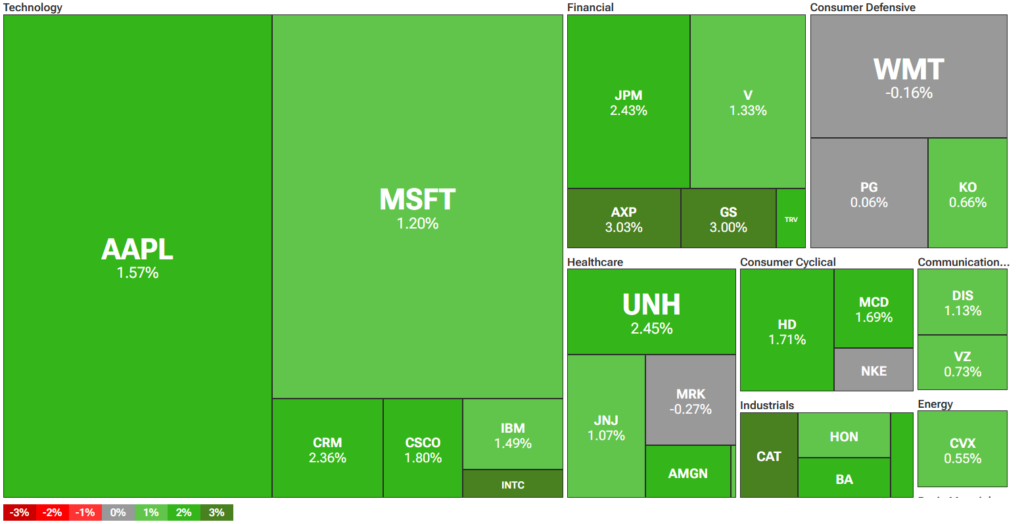

Diving into TipRanks’ Dow Jones heatmap, it’s almost completely green. In fact, there’s not a spot of red visible on the heatmap with the closest being some stocks remaining grey without significant movement. This shows that the whole market is helping lift the DJIA higher on Friday.

How to Invest in the Dow Jones

Traders can’t take a direct stake in the Dow Jones as it’s an index. Instead, they might consider buying the shares of a company listed on the exchange. Financial and tech stocks are big movers today, with Apple (AAPL) and JPMorgan Chase (JPM) offering strong investment opportunities to traders.

Another option traders will note is the ability to buy shares of an exchange-traded fund (ETF) that tracks the Dow Jones Industrial Average, such as SPDR Dow Jones Industrial Average ETF Trust (DIA). Below is a handy list of some of these ETFs for traders to compare and contrast.

See more Dow Jones ETFs

Disclaimer